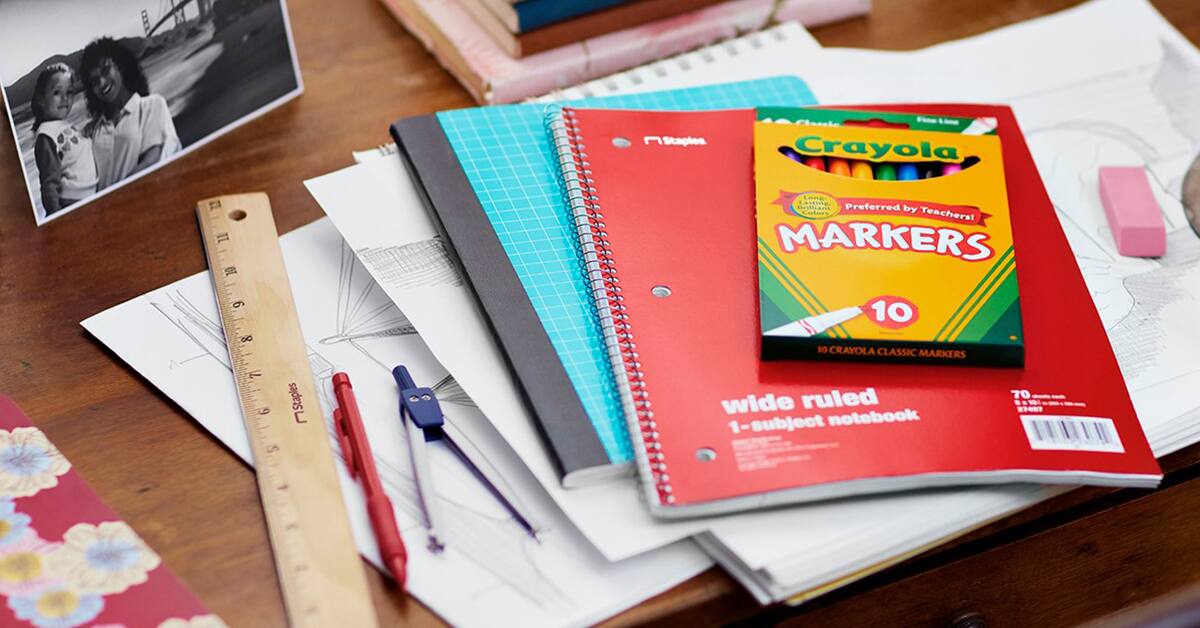

Coupons, Promo Codes & Daily Deals

Welcome to the hottest coupon codes of the day! Get the best savings at some of the most popular online stores.

Featured daily coupons

More coupons to love

Top coupons

Up to 90% off International Flights.

$15 Cash Back

Up to 80% off Flights with Deal Notifications.

4% Cash Back

Up to 75% off Cruises + Free Onboard Credit and Free Gratuities on select Sailings Plus $50 Cashback for Your Adventure.

2% Cash Back

75% off 2nd guest + bonus savings.

2% Cash Back

Get Up to 75% off Vacations with 'Deal of Fortune'.

Up to 2% Cash Back

Get Up to 70% off Last-minute Vacations.

1% Cash Back

Get Up to 70% off Last-minute Vacations.

Up to 2% Cash Back

65% off Pick Your Paradise Sale.

Up to 2% Cash Back